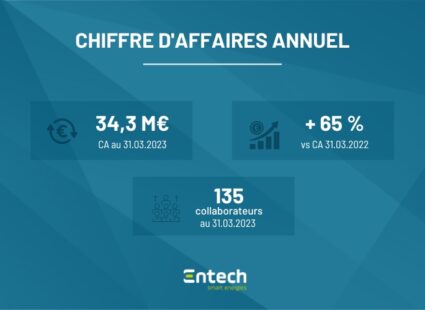

+65% growth in annual sales

May 2023

Entech reported annual sales of €34.3 million at March 31, 2023, up +65% on the previous year (€20.8 million). Growth remains strong in all 3 business segments. Against a background of structuring the company to absorb growth with larger projects, EBITDA for the 2nd half is expected to break even.

“With revenues of 21.5 million euros in the second half of the year, a level higher than the annual revenues at 31/03/2022, Entech is continuing its strong growth trajectory, thanks to the dedication of its teams. Following the success of our completed projects, our customers are consulting us on increasingly comprehensive and ambitious programs. As a result, we have stepped up our recruitment campaign in anticipation of upcoming projects,” says Christopher Franquet, Chairman and CEO of Entech.

Entech meets the challenges of the energy transition

The storage business is benefiting from very strong demand for on-grid projects in a context of energy transition and major geopolitical challenges. The business is also buoyed by strong momentum on multi-technology projects, or those combining electricity and hydrogen. This is why Entech is continuing to invest in R&D, as in the European C-3Poe program announced last February. Storage and hydrogen accounted for 52% of revenues last year, while Production (design and installation of photovoltaic power plants) represented 48% of sales. Most of these are large-scale ground-mounted plants. Entech is also responding to strong demand for self-consumption solar power plants, thanks to its specialized teams.

Project size: breaking new ground

For the year ending March 31, 2023, the size of projects is again on the rise, with an average order intake of 2,500 k€ in 2022 (year ending 03.31.23) compared with 1,474 k€ in 2021 for storage projects, and 2,093 k€ compared with 1,340 k€ for photovoltaic power plants.

In addition, Entech has been selected in a public tender (several local authorities) for the design and commissioning of storage systems at 6 sites. If this award is fully converted into firm orders, the project will represent a total capacity of over 50 MWh, making it Entech’s largest storage project to date.

Outlook

To prepare for the major projects of the future, Entech began investing in the second half of 2022/23, mainly to strengthen its teams. As a result, the Company is now well positioned to reach a significant new milestone in terms of project size.

These forward-looking investments should slightly dampen profitability in the 2nd half of the year, with EBITDA expected to break even. Our medium-term objectives for 2025 (financial year ending March 31, 2026) remain unchanged with revenues of around €130 million and an EBITDA margin of around 20%.

Next dates :

- Annual results at 31.03.23, June 27, 2023

- Annual General Meeting, September 6, 2023

- H1 revenues at 30.09.23, November 28, 2023

- H1 results at 30.09.23, December 12, 2023

Strong growth: +65% on the previous year (€20.8 million)